|

Life Insurance Error Gives Investors Bernie Madoff Style Returns

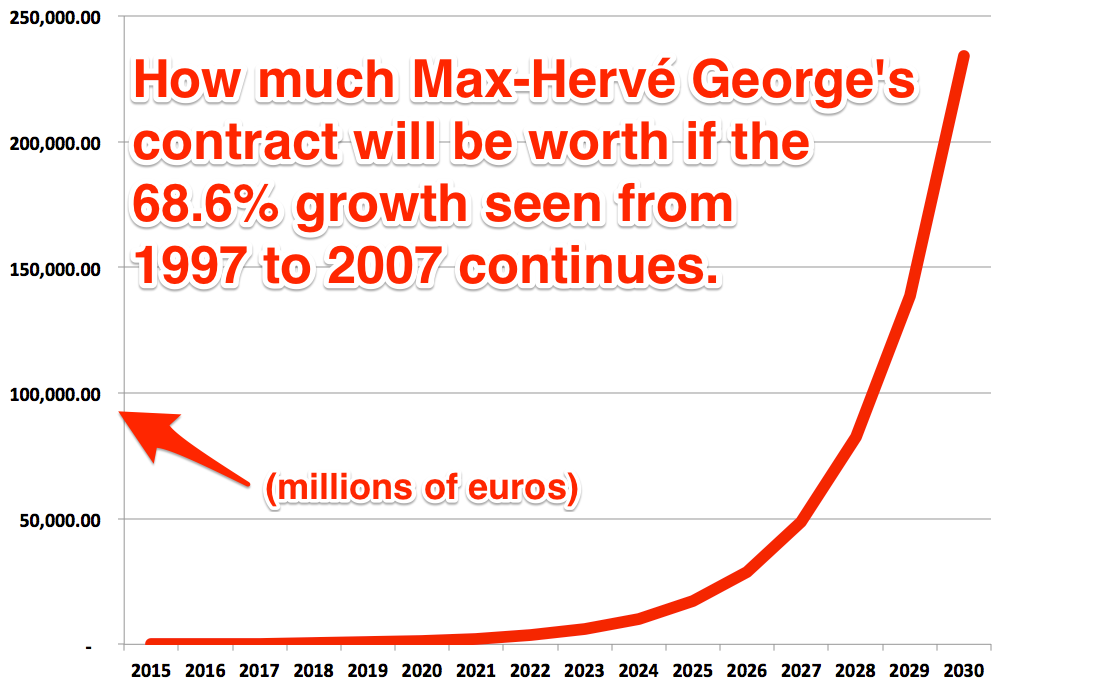

Featured in Zero Hedge Daniel Drew, 3/18/2015 Tweet Sometimes those perks for wealthy clients can be the downfall of your entire institution. In 1987, Aviva France started offering The Fixed Price Arbitrage Life Insurance Contract for wealthy clients. The Financial Times called it "the worst contract in the world". It allows the contract holder to invest with hindsight. Did you see a stock go up this week? Now you can buy it at last week's price. Did your stock plummet? Sell it at last week's price. It is the ultimate form of insider trading: time travel. Is it legal? Yes, according to French courts, Aviva France is bound by its contract. In 1987, market information was not as instantaneous as it is today. Trade processing times were slower, and fund values were not published frequently like they are now. Giving clients last week's prices was just a way to speed things up. Now, the contracts are still speeding things up - except this time, it's the speed of money being drained away from Aviva France. At age 7, Max-Herve George received this contract as a gift from his father. An expert at Paris District Court confirmed that the contract allowed him to achieve annual gains of 68% per year. In 2007, the family's investments were worth 10 million euros. Numbers after 2007 are not available, but it is impossible to lose because you can discard all losing investments at last week's prices. Once the insurance company realized their grievous error, they offered to replace the policies for 10 pounds. Thousands of idiot investors, oblivious to the benefits of hindsight investing, signed away their golden tickets. George refused. Who were the geniuses who came up with this idea? The major problem with this contract is that it's still a life insurance contract. Max-Herve George is only 25 years old. So in another decade, this contract could cost Aviva France billions. I hate to think this way, but if I were George, I would have a serious security detail. Aviva France would probably not grieve too much if George were to suffer a terrible accident.   |