|

LinkedIn's Loot and Pillage Accounting

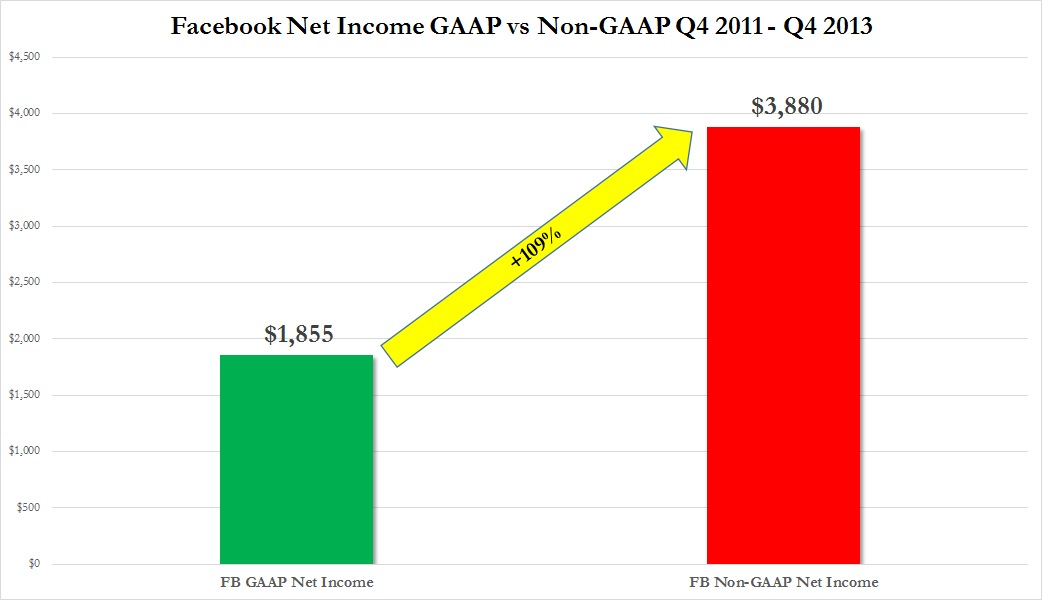

Daniel Drew, 6/20/2015 Tweet Recently, Gretchen Morgenson of The New York Times wrote an insightful article called "Tech Companies Fly High on Fantasy Accounting." She discussed the manipulative tactics that technology companies use to create a sense of unwarranted optimism in their investors. However, Morgenson is limited by the corporate constraints of The New York Times and was probably not allowed to be too heavy-handed in her discourse. But make no mistake: This is nothing less than bullshit accounting at its core. Accounting may seem like a dreary subject, but ignore it at your peril. While you are on lunch break, accountants are busy crunching numbers in the back office, operating a numerical machinery that sets the course of a company and changes people's lives. Even a single rule can undermine the fair treatment of employees, such as the rule that people are an expense, while inanimate objects like pencils are assets. This accounting rule wrecked the entire middle class. In the case of technology companies, the accounting issue at stake is called GAAP accounting. GAAP stands for Generally Accepted Accounting Principles. All companies are required to report earnings based on these standards. However, a company can create their own numbers as long as they still publish the GAAP numbers beside them. These "adjusted" numbers are allegedly more relevant than the GAAP numbers - and by "more relevant," I mean "more profitable." The basic goal of using any adjusted number is to exclude as many expenses as possible so income becomes inflated. The Non-GAAP numbers at LinkedIn are a perfect example of the loot and pillage accounting that pervades the industry. If you look at their 1st Quarter Report, the very first thing you see is "Company Metrics," which is what they want you to focus on. Their member page views are steadily increasing. That looks good doesn't it? But then take a look at their GAAP earnings, Non-GAAP earnings, and stock-based compensation for the last few years. Not only is Non-GAAP accounting a ridiculous stunt, it also shows how executives are looting the stock while the company loses money. According to GAAP accounting, the company has lost $30 million since 2013. LinkedIn wants you to believe they made $517 million during that time. Meanwhile, they have paid out $616 million in stock-based compensation. CEO Jeff Weiner received $47.4 million of stock-based compensation in 2013 alone. LinkedIn wants you to pretend like those payments never happened. That is the major source of this discrepancy in their Non-GAAP accounting. This kind of Non-GAAP absurdity is not limited to LinkedIn. Last year, Zero Hedge wrote about Facebook's use of Non-GAAP accounting. The discrepancy is astounding.  In her NYT article, Gretchen Morgenson quoted a study by Jack Ciesielski, publisher of The Analyst's Accounting Observer. The study showed a dramatic increase in GAAP vs. Non-GAAP discrepancies since 2009. As usual, the small investor discovers that upper management plays by their own rules. |