|

Low Wages and Unemployment are an Existential Crisis for Millions

Featured in Zero Hedge Guest Post by Jeff W, a contributor to the Charles Hugh Smith blog. 5/26/2015 Tweet A Note from Daniel Drew of Dark Bid: This post is a response to The End of Meaningful Work: A World of Machines and Social Alienation, an article I posted earlier. It is conducted in an interview style. Jeff W: There is a huge and growing problem of low wages and unemployment. It is an existential crisis for millions. If millions of young Americans don't start earning more money, they can't afford to have children, or take care of them properly, and that is the end of us as a nation. Even though I deplore government interference in the marketplace, the problem is so severe that it demands government action.  You were wrong to discuss the idea of redistributed capital ownership. This idea is not worthy of discussion. Many people would blow their capital on booze, gambling, and luxury cars. The proportion of people who would blow it gambling on biotech stocks would be very small in proportion, and you should not have used that example because it would apply to such a small fraction of cases. Because many people would quickly squander their capital and soon become welfare or charity cases again, this idea is not worthy of discussion and should not have been introduced. You are wrong to say that free trade has failed. People make their living in this world--they obtain the food, clothing, shelter and other goods and services they need--by working and trading. A functioning marketplace where people can trade freely, making their own decisions about what they will buy and sell, is very much a blessing to mankind. The historical record shows that Soviet-style, government-run pseudo-marketplaces fail the people because they prevent people from making their own decisions on how best to solve the problem earning a living. A free, thriving marketplace is a good thing. The problem is not that free markets are bad; it is that the corporatist thief state is in the advanced stages of crushing and dominating the markets where people can sell their labor. The idea of taxing companies that employ robots in order to subsidize companies that use humans more to interact with customers and vendors is wrong. People do not necessarily want to deal with a human being when it slows them down. I am happy to save time using an ATM. Your goal should be more to provide resources for human interactions outside of work. The age of robots should be an age of leisure where people can enjoy a rich variety of human interactions outside of work. In work settings, employees must interact with customers and vendors in robot-life fashion anyway, so they might as well be replaced by robots. You are on the right track with the idea of taxing companies that employ robots. You are off track on where that money should go. You are wrong to praise the Civilian Conservation Corps. My grandfather told me that people observed that there were often four CCC workers sharing one hoe. The workers also had an outhouse they could use when needed. What people said of them at the time was that there would be (in relation to the outhouse), "One a-comin', one a-goin', one a-shittin', and one a-hoein'." The CCC at its best produced a second-class kind of work. The work projects were dictated by a central authority in a manner not much different from the project planning methods used by the pharaohs. A big part of work being meaningful is that it is self-directed. A man who owns his own farm and builds it up through his own efforts is engaged in very meaningful work. A man who carves stone blocks to build a pharaoh's tomb is engaged in work that is much less meaningful.

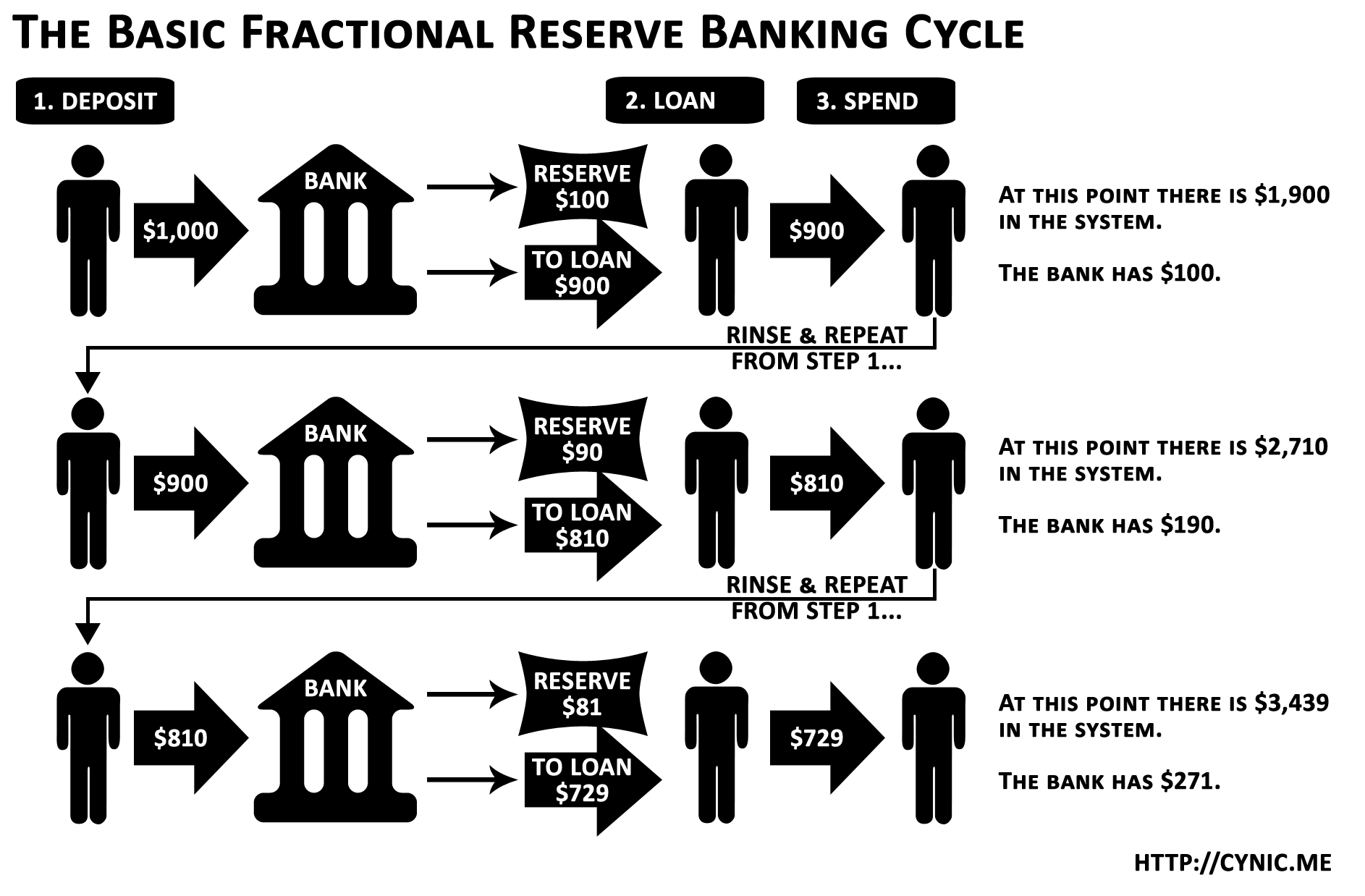

Daniel Drew: When I said "free trade" has failed, I meant free trade in practice. The concept of it is nice, but there has never really been free trade. It's always rigged in some way. Jeff W: Free trade is an ideal. Even though we admit that perfect free trade has never existed in a world ruled by force and fraud, that should not prevent us from striving toward that ideal: by resisting force and fraud as ways of getting money, and by insisting that people should get their money honestly from working and trading in an honest marketplace. That having been said, I support tariff protection of U.S. manufacturing. That support is based on my understanding of why Americans became prosperous while the equally intelligent and hard-working Chinese did not. Prosperity is synonymous with high private-sector wages. Wage prices increased in the U.S. due to supply and demand conditions. Labor oversupply in China has always depressed wages. In order to spread prosperity around the globe, high-wage nations should gradually absorb that labor oversupply in such a way that their own high wages are not reduced. Dumping huge labor oversupply on the market is like dumping a lot of wet logs on a campfire. Wet logs can be put on the fire gradually without putting it out, but if you dump a big load of wet wood on the fire all at once, you will put out the fire. That is why trade with low-wage countries must be managed. It is, at the same time, desirable for the U.S. to have free trade with high-wage countries like Canada, Australia, Japan and nations of western Europe. In a free-trade sphere composed of high-wage nations, political leaders could focus on maintaining a fair trading environment for all participants, and each nation's business leaders could focus on competing on price and quality. A thriving free-trade sphere could then absorb a good deal of low-wage labor each year without damaging itself. Today's regime of global labor arbitrage (which is supported by global corporations under the spurious slogan of Free Trade) is spreading low-wage misery around the globe, extinguishing high wages where they used to be found.  Daniel Drew: If we tax companies that employ robots, where should the money go? Jeff W: Sources of tax money include companies that employ robots and rentiers. The tax money should be used to subsidize employers. Suppose there were a $10,000/year subsidy payable to each employer for each full-time employee. Employers would be free to pay employees as they choose. Non-profits would also be eligible to receive subsidies. One might imagine a small rural church with an annual budget of $40,000. If the minimum wage were $7/hour, such a church might be able to employ ten full-time workers. If the problem in my community were too many wolves running loose, killing all the livestock, then I might pay a bounty to each hunter for each wolf pelt he brought in. Similarly, if the problem is not enough jobs, I would pay employers bounties to create jobs. That is the direct government approach to job creation. Once there are enough jobs for everybody, the law of supply and demand can start working in favor of employees; there would be a scarcity of workers, and employers would have to bid higher for labor; then we would finally see wage increases. A key advantage of employer subsidies vs. guaranteed income is that with employer subsidies, employees become involved in the marketplace. They learn new skills. They produce marketable products. As they progress up the learning curve, employers can increase their wages. Economic progress can occur. By contrast, guaranteed-income welfare clients just sit like a dead weight on the private sector, imposing a huge and growing tax burden on a private sector that is already overburdened. The best thing that government can do for working people is to create an abundance of jobs. When there is an abundance of jobs, workers can easily quit one job and find another. The ability to do that is key to the pursuit of happiness; where workers are bound to jobs and have no alternatives, they cannot easily make changes to improve their conditions. Daniel Drew: I would like to hear any more stories or first-hand accounts you may have about the Civilian Conservation Corps or anything regarding "The New Deal." Jeff W: I don't really have many New Deal stories, but I'll tell you another one from my grandpa. He was a policeman in Detroit, but he was also a real estate speculator. He bought and sold hundreds of houses in the course of his career. He told me a rumor he heard during the Depression. People couldn't understand where all the money had gone. In the 1920's, everybody had a lot of money. In the 1930's, nobody seemed to have any money. Where did it go? The rumor in Detroit was that Henry Ford had invented a baling machine that would take stacks of currency and wrap wire around them, like a hay baler. After baling the stacks of currency, Ford then stored his cash bales in a warehouse. That rumor, which circulated widely in Detroit, explained where all the money had gone. Then as now, people did not understand the workings of the fractional reserve banking system, how it creates money when loans are made and how money is destroyed as loans are repaid. In the Depression, when few new loans were being made, money quickly disappeared.  Daniel Drew: It has been a privilege to have Jeff W on the blog today. Guest submissions are welcome at Dark Bid. |