|

A Wall Street Crash Course: How To Sell $1 For $100

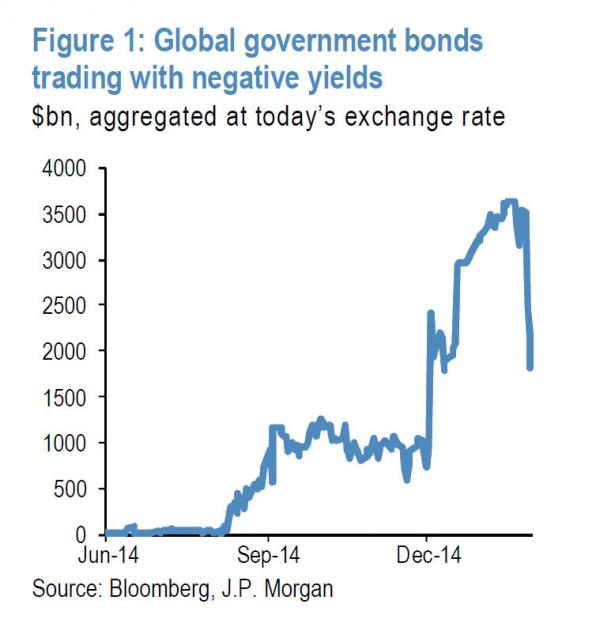

Featured in Zero Hedge Daniel Drew, 6/29/2015 Tweet  On Wall Street, a vital skill is the ability to sell something that you know is completely worthless. Goldman Sachs did it when it sold ABACUS 2007-AC1 to investors while hedge fund manager John Paulson was betting against it. Paulson paid Goldman $15 million to peddle this junk, which was a collateralized debt obligation that would make money when millions of people lost their homes. The SEC charged Goldman with fraud, and they eventually settled for $550 million. If you're an enterprising Wall Streeter who wants to make a name for himself without breaking the rules, you can operate a tantalizing scheme that investors can't resist. It's called Shubik's Dollar Auction. The Dollar Auction was created in 1971 by Martin Shubik, a professor at Yale. Shubik was friends with the late game theorist John Nash, and in their spare time, they amused themselves by creating parlor games that were nothing less than diabolical. Wall Streeters are usually familiar with traditional risky games like No Limit Texas Hold'em and Liar's Poker. However, the Dollar Auction trumps all of those games by taking loss aversion to the next level. The Dollar Auction works like any other auction except for one key rule: the second-highest bidder has to pay his bid in full and gets nothing in return. Experienced traders will immediately foresee how this will play out. Gather a large group of people in a room and start the bidding. Initially excited by the prospect of getting a dollar for pennies, people will start bidding. Even at 50 cents, they are still getting a bargain. No one worries about being the second-highest bidder because there are so many other people in the room. As the bidding gets closer to $1, bids will start dying out. Eventually, someone will bid $1. At that point, there will be no new bidders, but someone is still stuck at 99 cents. That person is facing a guaranteed loss of 99 cents. If they bid $1.01 and win, they can get the dollar and only take a 1 cent loss. So they figure a 1 cent potential loss is better than a 99 cent guaranteed loss. However, the other remaining bidder is thinking the same thing. These two bidders will run up the price as high as necessary until one of them eventually decides he can't take it any longer. There is no limit to how high the insanity can go. Meanwhile, the auctioneer keeps both bids and only gives up one dollar. The Dollar Auction is the perfect metaphor for Wall Street. Both involve setting the clients against each other and taking fees for yourself. The Dollar Auction mindset can also be seen in the post-crash bizarro bond markets. As a response to what seems like unlimited quantitative easing, bond investors have bid up the price of bonds to the point where they are actually locking in a loss on their investment right from the beginning. As Zero Hedge reported earlier this year, 16% of global government bonds have a negative yield; that's $3.6 trillion.  The logic behind this behavior is that yields will become even more negative or deflation will occur. Bond investors are scrambling to avoid becoming the second-highest bidder in the global bond market frenzy. However, with QE failing in Sweden, and with the CDS market collapsing, this will not end well. When Shubik created the Dollar Auction over 40 years ago, I doubt he could have imagined that the madness of his diabolical parlor game would be playing out in the global bond markets. |