|

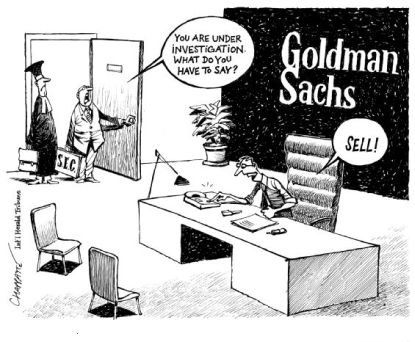

Goldman Sachs Rookie Analyst Almost Escaped Before Falling To His Death

Featured in Zero Hedge Daniel Drew, 6/2/2015 Tweet  From the early days of Zero Hedge in 2009 to Matt Taibbi's 2010 critique, "The Great American Bubble Machine," Goldman Sachs has been one of the all-time favorite punching bags in critical circles. It's easy to imagine Tyler Durden in a Fight Club style brawl with Lloyd Blankfein, taunting him, "No bailouts this time." Taibbi called Goldman "a great vampire squid wrapped around the face of humanity." This time, their victim was Sarvshreshth Gupta, a rookie analyst just 22 years old from the University of Pennsylvania. Gupta was found dead in a parking lot next to his apartment building on the corner of Sacramento Street and Brooklyn Place in San Francisco. He apparently fell from the building. After working 100 hours a week, he told his father, "This job is not for me." In March, he quit. However, like the crazy woman in Fatal Attraction, Goldman was not going to be ignored. A week later, Goldman urged him to reconsider. His father encouraged him to return, and he did. Gupta was put on a reduced schedule (does 70 hours qualify as reduced?) However, it was just a ruse, and Gupta was back up to 100 hours again soon enough. On April 16 at 2:40 a.m., he called his father again, "It is too much. I have not slept for two days." This time, his father told him to quit. Gupta said he would leave the office soon. Several hours later, he was found dead in the parking lot. Goldman strikes again. Just six weeks later, Thomas Hughes, an associate at investment bank Moelis & Co., jumped off his luxury apartment building in Manhattan. Witness Mario Mroczkowski said that Thomas was decapitated after hitting a guard rail. All of this reminds me of another story two years ago. Moritz Erhardt was a 21-year-old intern at Merrill Lynch. After working all night for 3 days in a row, he collapsed in the shower and died. Bankers have become the modern day chimney sweepers as far as physical health is concerned. Yes, they are well-paid, but it's hard to enjoy your money when you're at the office all night or when you're dead. Even the financial career website "e-financial-careers" published an article called "How banking can ruin your body and mind." When a large career network releases the financial equivalent of the surgeon general's warning, that should catch your attention. According to Tim Bean, a trainer who works with bankers at Lloyds, 51% of men working in the City who are over 40 years old have erectile dysfunction. From caffeine to alcohol to cocaine, the banker's body is a pharmaceutical playground. One notable excerpt from the article is called "The banking body-abuse cycle:" Michel studied two departments at two investment banks (one comprising corporate financiers, the other salespeople and traders) and conducted hundreds of interviews. She eventually concluded that bankers go through a cycle of bodily abuse until they either drop out or take control.One solution is to avoid banking entirely. Gupta had the right idea, but the Goldman Sachs vampire squid sucked him back into the office. In a world where corporations have rigged the job market, college graduates can't find work, and machines are taking over nearly every job, Gupta was just trying to survive by taking one of the few opportunities left in the post-crash world. |